michigan unemployment income tax refund

I filed a tax return I had a tax return filed on my behalf. The Michigan Department of Treasury is urging taxpayers to file amended Michigan individual income tax returns if they have already filed without reporting unemployment compensation exclusions for the 2020 tax year.

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Then the creditor must file the writ with the Department of Treasury.

. You would be refunded the income taxes you paid on 10200. Allow 2 weeks from the date you received confirmation that your e-filed state return was accepted before checking for information. If you use Account Services select My Return Status once you have logged in.

However you dont pay tax in Michigan on unemployment if you no longer live in Michigan. North Dakota taxes unemployment compensation to the same extent that its taxed under federal law. When you create a MILogin account you are.

If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings. Michigan unemployment officials say 12 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February. See How Long It Could Take Your 2021 Tax Refund.

The refunds are only for people with a gross income under 150000 and only counts toward the first 10200 of unemployment earnings in 2020. The 10200 is the refund amount not the. You pay tax in your home state only.

Check For The Latest Updates And Resources Throughout The Tax Season. What Is Form 1099. Please allow the appropriate time to pass before checking your refund status.

Ad Learn How Long It Could Take Your 2021 Tax Refund. Allow 6 weeks before checking for. Previously taxpayers were encouraged to wait to make any.

You received a letter from the Michigan Department of Treasury directing you to this web site to confirm your identity or identify the return as suspicious. However if you werent eligible to receive additional tax benefits predicated on your 2020 income such as the earned income tax credit and youre now eligible for those benefits because your 2020 taxable income is now. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits.

Michigan residents who lost their jobs in 2020 and filed their state income tax returns early this year need to file an amended state return to get extra cash back from a new tax break. State Income Tax Range. A quick update on irs unemployment tax refunds today.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. The rule change only applies for 2020 tax must be. This is the latest round of.

There are two options to access your account information. Garnishment of State Tax Refund by Other Creditors. Account Services or Guest Services.

The creditor must also. 11 on up to 40525 of. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

How to check your irs transcript for clues. And federal income tax refunds to offset unemployment compensation debts. Before starting this process please select the appropriate option below.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. You may check the status of your refund using self-service. If a creditor has a judgment against you and wants to garnish your tax refund it must file a Request and Writ for Garnishment with the court.

State Taxes on Unemployment Benefits. Say Thanks by clicking.

Eservices Individual Income Tax

Tax Forms For Michigan Unemployment Claimants Now Available Online

Tax Services Charlotte Payroll

Irs Issues 510 Million In Refunds To Taxpayers Who Overpaid On Unemployment

Income Tax Season 2022 What To Know Before Filing In Michigan Detroit Mi Patch

Michiganders Who Received Unemployment Benefits In 2020 Will Not Face Tax Penalties

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

/1099g-b89de84cce054844bd168c32209412a0.jpg)

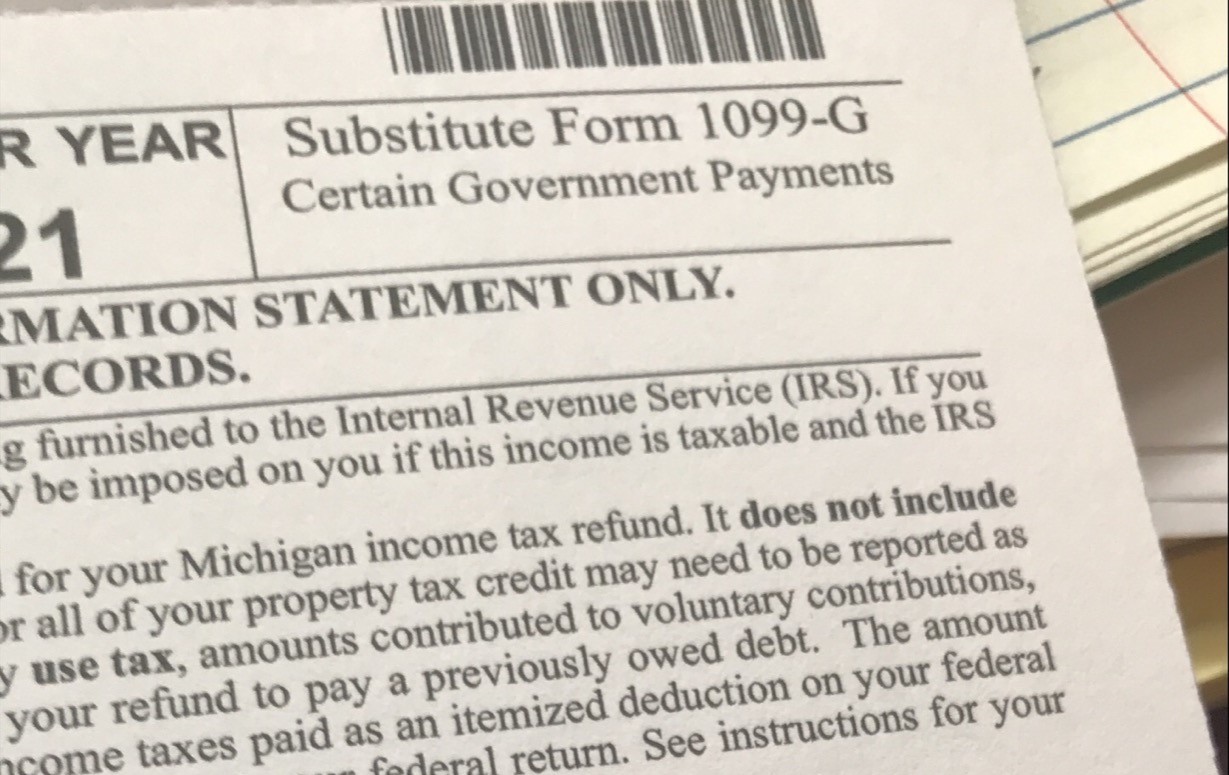

Form 1099 G Certain Government Payments Definition

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

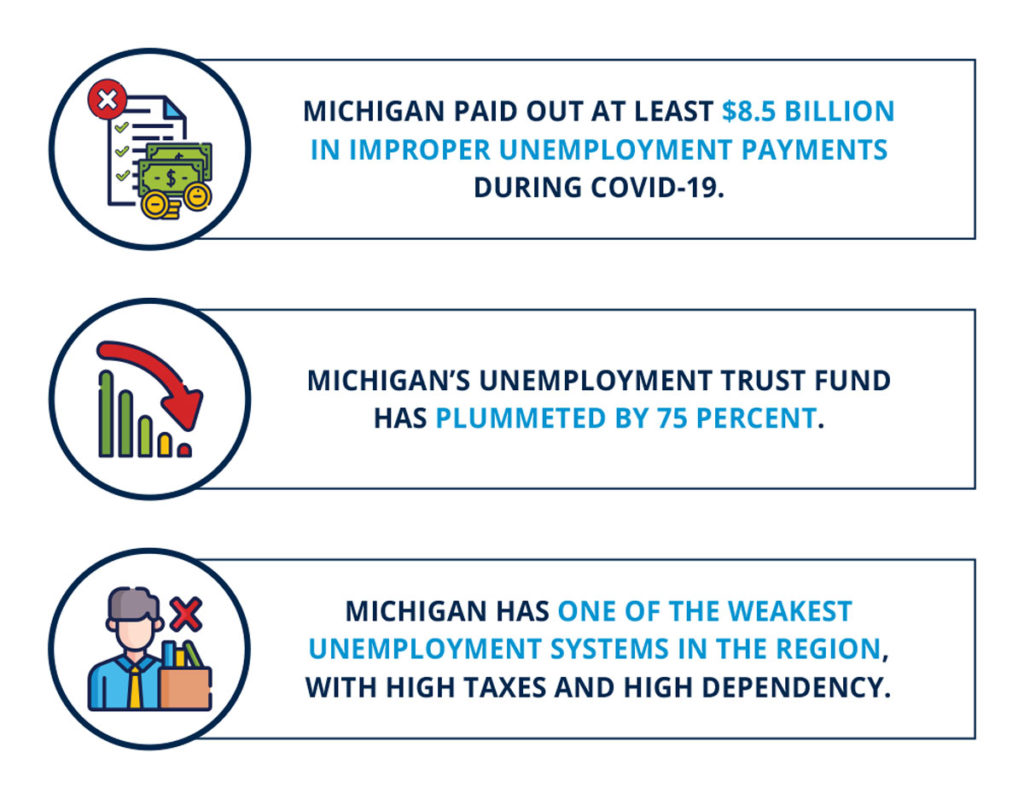

Michigan S Unemployment System Is Broken But Can Be Fixed

Michigan Unemployment Benefits For Limited Liability Company Members Rehmann

What Is A 1099 G Form And What Do I Do With It

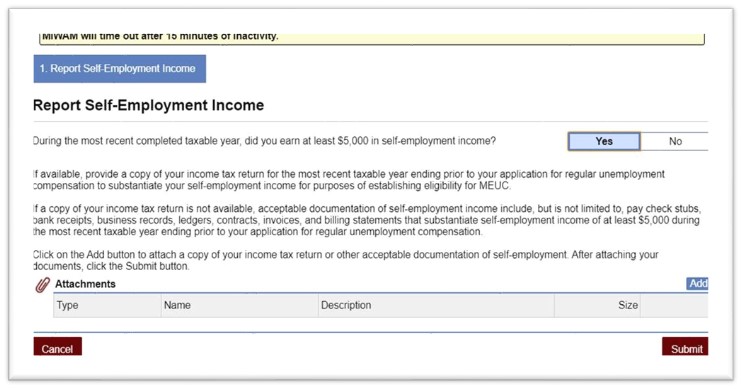

How To Apply For Michigan Uia Mixed Earners Unemployment Compensation Meuc Program Michigan Unemployment Help Career Purgatory

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post